Who Else Wants Info About How To Avoid Double Taxation

Do you want to skip the line and get the answers to your questions right away?

How to avoid double taxation. It is precisely to avoid double taxing the same investor's same income that countries sign a tax treaty. However, it should be noted that. How to avoid double taxation:

If you do choose to incorporate as a c. The double taxation avoidance agreement is an agreement between two countries to avoid double taxation on a single source of income. In an ideal world, there would be a state reciprocal agreement in place to prevent double taxation.

By doing so, the owner will only pay for taxes once, in the form of a personal income tax. How to avoid double taxation. Dtaa provides residential status is to be determined based on the domestic laws of each country.

Double taxation avoidance agreements (dtaa). The dtaa is a tax treaty between two or more nations to help taxpayers. Can you use both the foreign tax credit and the foreign earned income exclusion?

Ways to avoid double taxation 1. In order to avoid double taxation, a person can claim a foreign tax credit. Dtaa will provide relief from.

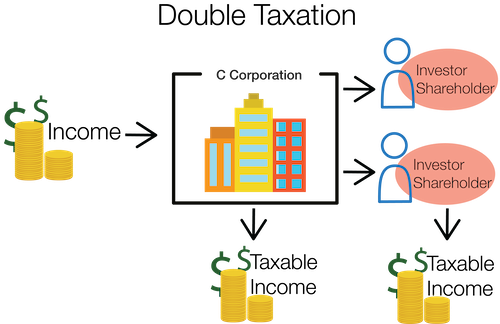

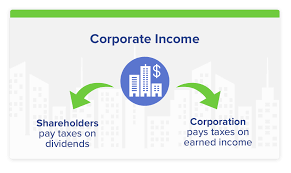

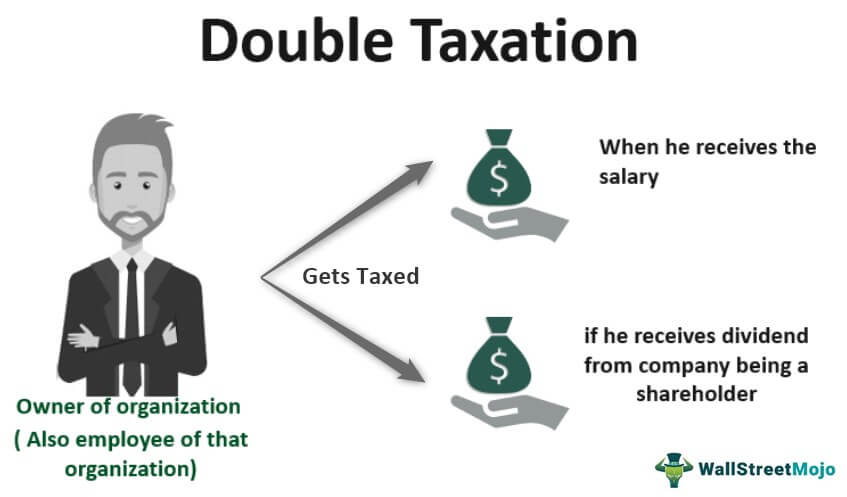

Mutual fund investors will owe taxes on any dividends or. Payments to a qualified plan not only avoids a double level of taxation, but also allows the deferral of the compensation to the recipient target shareholder and enables earning income. Double taxation is usually eliminated by providing foreign tax credit (ftc) in the residence country.

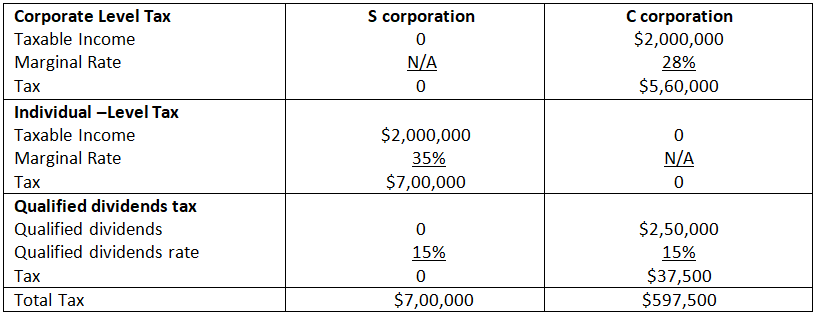

There are several methods you can use as a foreign entrepreneur to avoid the inconvenience of double taxation. The best way to avoid double taxation is to simply not structure your business as a c corporation. Can you avoid double taxation in your business?

In this scenario, the choice is to simply retain corporate earnings instead of distributing it to shareholders via dividends. This strategy eliminates the second part of double. You can avoid double taxation by keeping profits in the business rather than distributing it to shareholders as dividends.

If a state reciprocal agreement is not in place, you will need to withhold taxes. The strategies may be more complex but there may be various ways to legally avoid double taxation, such as getting tax exemption from a foreign source of income or credit. In case you, as an nri/pio, qualify as tax residents of both countries, the treaty may provide for a tiebreaker rule.

Individuals claim foreign tax credits on a form 1116. Really, it comes down to your lifestyle, where you live, and how much money you make. Avoid double taxationhow many videos of james have you watched today?