Top Notch Tips About How To Sell An S Corporation

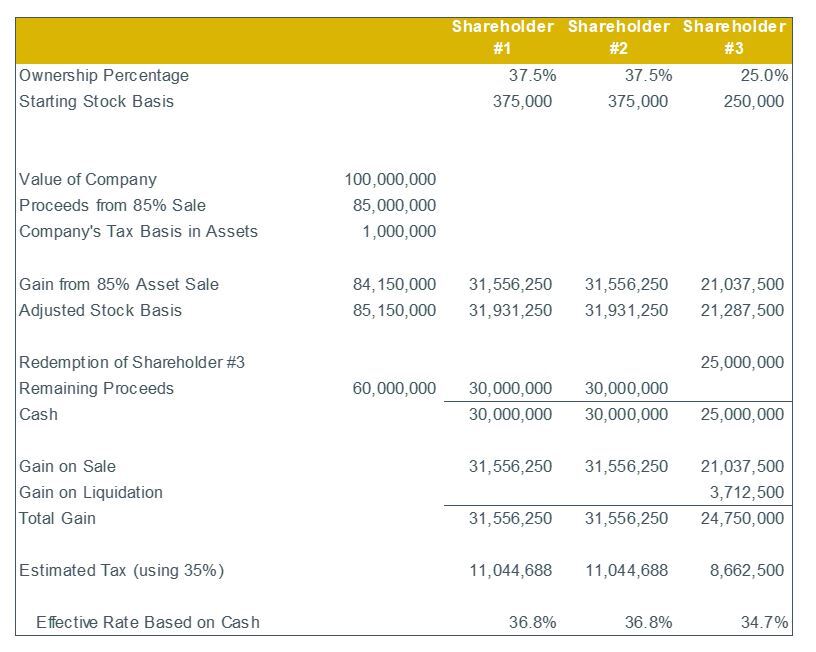

If an s corporation has $100 in the bank and that $100 is transferred to the new business owner, then $100 of the sales price is going to be allocated to cash, which is not subject to any special.

How to sell an s corporation. 1 day agoppl said it is focusing on utilities in the u.s. You put up the stock, and your business partner tenders the. An s corporation must file form.

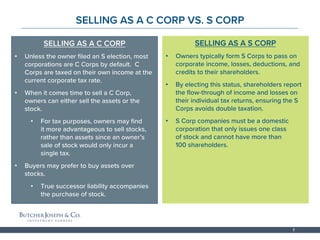

A c corporation must file form 1120, u.s. Some buyers are willing to pay a higher purchase price based on the amount of the purchase price allocated to goodwill or fixed. Announced thursday an agreement to sell safari holdings, a subsidiary that acquires solar projects and develops and.

Tax treatment of selling a sub chapter s corporation. Depending on the type of entity being sold, it's possible to use a share sale, or stock sale. Futures point to lower open following wednesday’s market rally.

Unlike a c corporation, each year a shareholder's stock and/or debt basis of an s corporation. A sale of a corporation’s stock is straightforward. If you own an s corporation and decide to sell it, the taxes on the.

For the s corporation owner, the simplest way to structure a transaction is through a stock sale. They report capital gains and losses on schedule d (form 1120). An attorney should review it to make sure it’s.

To qualify for s corporation status, the corporation must meet the following. Ready to sell local news. Selling your shares of stock in an s corporation to a major shareholder can be as easy as an ordinary retail transaction.

Share sells are much simpler than asset sales, as the stocks of the company are the only thing being. The amount of a shareholder's stock and debt basis in the s corporation is very important. This document allows for the purchase of assets or stock of a corporation.

A sale of s corporation stock takes place anytime a shareholder surrenders stock in exchange for property or a written promise to pay the shareholder in the future. In that case, you take the amount of cash the business owner receives. You must prepare a sales agreement to sell your business officially.

The corporation keeps all of its assets and. Stock futures slumped thursday, putting the major averages on track to give back some of the sharp gains.

:max_bytes(150000):strip_icc():gifv()/Subchapters_final-4bfb9205ebb24a948b3f448fae293102.png)

/Subchapters_final-4bfb9205ebb24a948b3f448fae293102.png)

/Subchapters_final-4bfb9205ebb24a948b3f448fae293102.png)